Court documents reveal that Stephanie Hockridge, aged 41, and her husband, Nathan Reis, aged 45, engaged in the fabrication of records to assist businesses in obtaining higher loan amounts.

A couple from Phoenix, including a former news anchor, has been charged with fraud related to COVID-19 relief loans, as per the Department of Justice.

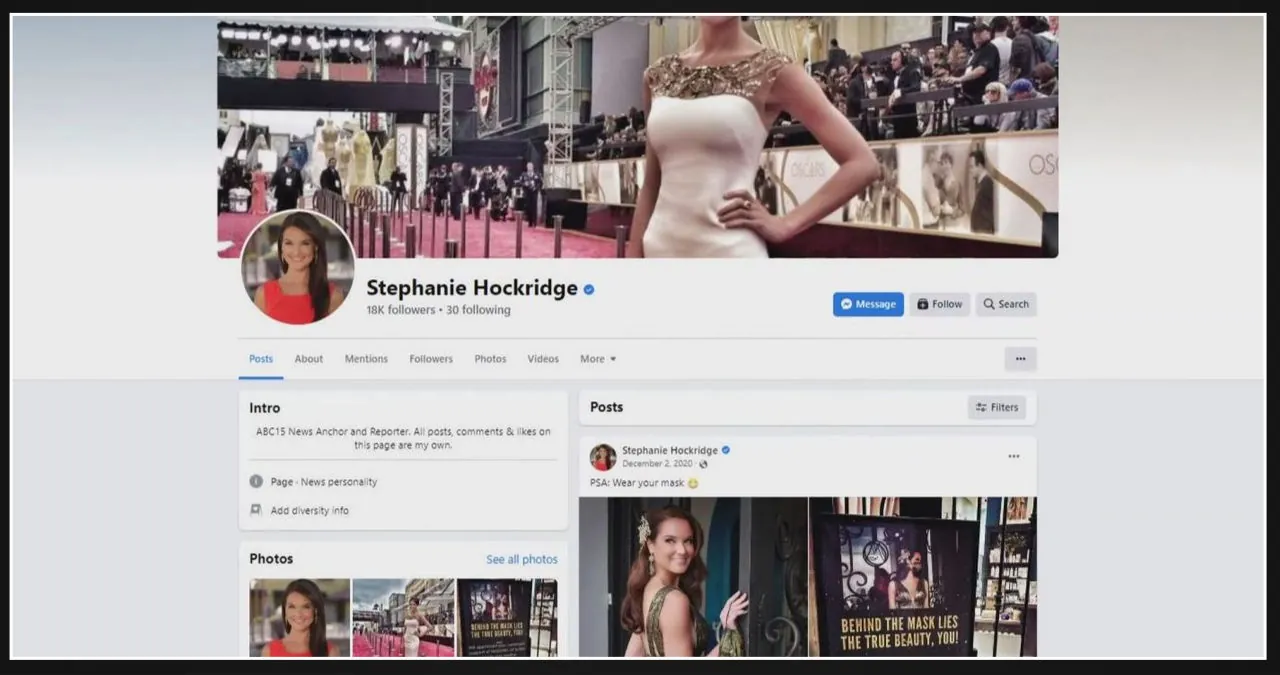

Stephanie Hockridge, a former news anchor also known as Stephanie Reis, and her husband Nathan Reis, have been charged with submitting fraudulent Paycheck Protection Program loan applications. The indictment against them was unsealed on Thursday in the Northern District of Texas.

Reis and Hockridge teamed up in April 2020 to establish Blueacorn, with the aim of assisting small businesses and individuals in obtaining PPP loans, as per court records.

Reis and his co-conspirators are accused by prosecutors of creating fraudulent documents, such as payroll records, tax documentation, and bank statements. According to the allegations, Reis and Hockridge unlawfully demanded borrowers to pay kickbacks, which were calculated based on a percentage of the funds they received.

According to court documents, Reis, Hockridge, and other individuals involved in the alleged scheme expanded Blueacorn’s operations by entering into lender service provider agreements (LSPAs) with two lenders.

Blueacorn, as part of the Lender Service Provider Agreements (LSPAs), was responsible for gathering and assessing PPP applications from potential borrowers on behalf of the lenders. They collaborated closely with the lenders to submit these applications to the SBA. In return, Blueacorn received a portion of the fees that the SBA paid to the lenders for approved PPP loans.

Blueacorn had a program called “VIPPP” where Hockridge and his team provided personalized assistance to potential borrowers in completing their PPP loan applications. As part of this program, Reis and Hockridge allegedly enlisted co-conspirators to serve as VIPPP referral agents and guide borrowers on how to submit fraudulent PPP loan applications.

Prosecutors allege that Reis, Hockridge, and their co-conspirators knowingly submitted PPP loan applications containing false information in order to obtain more kickbacks and lender fees from the SBA.

Reis and Hockridge have been accused of conspiring to commit wire fraud and committing four counts of wire fraud. If found guilty, they could potentially face a maximum prison sentence of 20 years for each count.